Maybe at last we are seeing some concrete forward movement in dealing with this troubled sector and we have to collectively put aside personal issues from all quarters of the industry and work in cohesion with the government in making the most of these policy decisions. The rescue package may not be the saviour of the industry but it is the first comprehensive plan of action we have seen from government. As for the implementation of tariffs there will always be debates from different political and social economic spectrums about their worth.

What the industry as a collective needs to do is work with government in focusing on illegal imports. Companies and individuals conducting such business must be brought to book and exposed.

The industry must upgrade every level of its operations to become viable and build stronger relationships with the powerful retail sector in the area of service delivery and costing. Pressure must be placed on retailers not to support unregistered apparel suppliers and in turn, retailers need to educate their buyers on the complexities of the industry.

The announcement that certain textiles will be exempt of tariffs duties is a pleasing outcome for the fashion sector as access to textiles and the cost incurred to designers has been a contentious issue. Our fashion sector needs to now exploit this opportunity by creating closer workable links down the value-chain between designers, manufacturers and retail.

The one concern is the direction of possible union activity within the apparel sector. Jobs will continue to be lost and I expect there is immense pressure being placed by the Southern African Union of Textile and Clothing Workers Union (Sactwu) on its former boss, Embrahim Patel, who is now a minister of economic development in Zuma's new cabinet to deal with the loss of jobs and factory closures.

Globally textile and clothing trade grew by 10.6% to US$583bn in 2007, while textile exports from Asia to Africa increased by 18% and from Asia to Europe rose by 16%. The world's biggest textile exporter in 2007 was the EU27, followed by China, Hong Kong, the USA, South Korea, Taiwan, India, Turkey, Pakistan and Japan. The EU27 was also the biggest textile importer, followed by the USA — although China ranked as high as third, followed by Hong Kong, Japan, Turkey, Mexico, Vietnam, Canada and Russia.

In clothing, China was the world's leading exporter for the second year running, followed by the EU27, Hong Kong, Turkey, Bangladesh, India, Vietnam, Indonesia, Mexico and the USA. As for clothing imports, 46% of the world total went to EU countries in 2007, while the USA took 24% and Japan took 7%. The countries which followed in importance had only small shares and included Hong Kong, Russia, Canada, Switzerland, the United Arab Emirates, South Korea and Australia.

It is estimated that the South African apparel and textile sector is the sixth largest manufacturing sector employer and 11th largest exporter of manufactured goods. A total of 230,000 people are estimated to directly be employed in the industry with a further 200,000 employed in dependent industries.

In 1939 the clothing industry consisted of 268 factories employing about 19,000 workers and by 1959 there were 560 factories employing 49,000 workers with 844 firms registered in 1960. This equates to roughly 3770 jobs per year since 1960.

Much of the debate relating to formulating a policy future and past to "rescue" the South African apparel sector has been thwarted with political motivation and interest groups pushing their own agenda and a lack of trust between various sub-sectors within the apparel sector. For an industry sector that contributes an estimated 11% of all manufacturing employment and as part of the manufacturing sector which contributed 16.2% of annual GDP , the delay in finding a cohesive policy and the in-fighting is inexcusable.

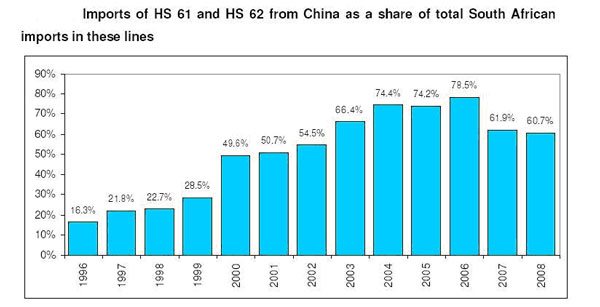

The implementation of the controversial quotas on Chinese apparel, which was implemented in 2007, came about due to the surge of imports in both clothing and textiles after South Africa went down the road of trade liberalization in the 1990s. China has and continues to be a needle in the discourse of South Africa's clothing and textile industry, however new arrivals have dispersed the total negative influence of China for these sectors. In 1996, imports for China accounted for just over 16% of the total clothing imports, growing to an alarming 75% in 2006, which then dropped as would be expected during the quota period.

New import players such as Vietnam, Bangladesh and Malaysia actually saw an increase by 33% in imports from the "HS lines which the quotas targeted" during the quota period.

Data reflects that during the quota period domestic output of clothing and textiles increased by 2.68% in 2007 but decreased by 1.46% in 2008.

When the quotas were implemented Ebrahim Patel, then general secretary of the Southern African Clothing and Textile Workers' Union (Sactwu), said that 55,000 jobs would be created the very opposite happened. A researcher from Sactwu said that jobs losses were "substantially less" than before the quotas - an admission that employment did not grow as was expected, which was one of the fundamental selling points directed to the industry and government by the union as a reason why the quotas needed to be implemented. It is interesting to note that Sactwu is unable to provide evidence of the number of job increases that occurred during the quota period. However, there is evidence of job losses during this period. The December 2008 Quarterly Employment Statistics show a decrease of 35,000 jobs in the manufacturing sector and 22,000 lost jobs in the same sector for 2007 with the apparel manufacturing sector "listed as contributing to the overall decrease in manufacturing employment."

With clothing companies continuing to close over nine companies and 5000 people losing their jobs within the first three months of 2009 (with the expectation of more job losses in the months to come), the DTI's prediction that the industry will shed a total of 20,000 jobs a year over the next two to three years makes a mockery of Zuma's promise to increase jobs. Apparel imports have grown by 64% in value and 12% by volume in January 2009 in comparison with the same period in 2008, while exports of textiles and clothing are down 9% for the same period.

The dispute about the amount of people who have lost their jobs is immaterial. The DTI says that over the past six years, employment in this sector has decreased by 39%, equating to a loss of 69,000 jobs. The fact is jobs have been lost and there is very little scope of large re-employment in this sector unless the tariff implementation and rescue plan work, but this will be contingent on the industry taking advantage of any opportunities these economic policies present.

The cost of labour is an issue that also needs to be addressed and as I have eluded to, the relationship between retailers and suppliers to the demand for shorter delivery times and flexibility of manufacturers still hampers the relationship and support of local manufacturers by South African retailers (which is backed up by a report).

With tariff implementation planned it is pleasing note that an increase in protectionist tariff for textiles is excluded from the targeted lines that mostly consist of clothing imports that could be produced in South Africa. The notice on 13 June that import "duties will be cut on a range of fabrics not made in commercial quantities in South Africa " is a welcome note for the industry and for fashion designers. This could result in a manufacturing reduction of at least 10% in locally made apparel. Not everybody is happy with this. The Textile Federation (Texfed) said the body was concerned with some of the provisions on the fabrics and has registered its concern with the International Trade Administrative Commission (Itac).

However, the difference between bound and applied tariffs lines is so minimal in the South African context that will the implementation of tariffs actually do the job of both protecting and increasing employment in this sector and provide incentives for the industry to restructure?

The debate of tariff implementation within the South African clothing and textile sector is not new. The 1925 New Customs Tariff Act was the first truly protectionist policy to provide "space for growth in the industry," and by the 1960s a total of 400 items fell under tariff protection for the clothing and textile sector.

Past evidence shows that the South African textile sector in the 1950s was in a similar position as it is now with the industry complaining that it could not compete on an "equal footing as per competitor countries." One wonders what development has occurred in the last fifty years. Between 1958 and 59 the local apparel sector used up to 36% of locally produced textiles however the apparel sector reported that "quantity, qualities, types, finishing and delivery" was a problem when supporting local textile suppliers.

It is noted that the government has listened in some aspects to the industry. The removal of tariffs on certain textile lines, the implementation of the rescue plan and the focus on illegal imports are examples. Government and the industry must now put aside past differences, move forward and work together to make the best of these economic instruments. If there is going to be union action from Sactwu it is best if they change their tactics. They should not target the industry as a collective. They should target retailers supporting unregistered apparel manufacturers, work closer with apparel employers in finding mechanisms to save jobs within individual companies, and develop a strategy to target individuals within government. I firmly believe our leadership should be demonstrating and walking the fashion by wearing locally designed and made clothing. Admittedly the South African government has made blunders and created a difficult environment for this sector. The industry now needs foster stronger ties with government and within to build a unified industry that has one vision-growth.