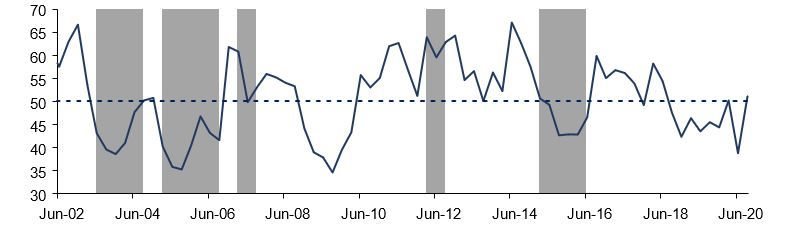

This corroborates various high-frequency data which show that most of South Africa’s agriculture and agribusiness sectors have not been severely affected by the ongoing Covid-19 crisis, as the sector was classified as essential and largely did not close down throughout the lockdown period. The subsectors that were severely affected by the lockdown regulations include the wine and tobacco industries, whose sales were prohibited for certain periods. This third-quarter survey was conducted in the first two weeks of September and covers agribusinesses operating in all agricultural subsectors across South Africa.

• The ACI comprises 10 subindices and most of these showed a notable uptick in the third quarter of the year. Confidence regarding the turnover and the net operating income subindices improved by 21 and 26 points from the second quarter to 50 and 47 points, respectively. This optimism emanated from firms operating within the field crops, horticulture and financial services. The underpinning driver is large outputs in the 2019/20 production year, coupled with higher commodity prices.

• The market share of agribusinesses subindex improved by 1 point to 64 in the third quarter of 2020. The grainoperating agribusinesses were the key drivers of this uptick, while most agribusinesses maintained a generally unchanged view in this specific subindex compared to the previous quarter.

• The capital investments confidence subindex improved by 6 points from the second quarter to 44. This is linked to generally improved financial conditions of farmers on the back of the larger harvests and higher commodity prices. The monthly sales of movable assets such as tractors and combine harvesters have been fairly robust of late, at levels higher than 2019 since June 2020.

• The subindex measuring the volume of exports sentiment improved by 19 points from the second quarter of 2020 to 55 in the third quarter. This too is supported by large agricultural output, which combined with the weaker domestic currency, have led to a notable uptick in exports of agricultural products over the past few months.

• The perception regarding general economic conditions in the country improved by 10 to 19 in the third quarter of this year. This, however, is still far off the neutral point of 50-mark, which indicates some persistent level of pessimism. The improvement recorded in the sentiment might have been influenced by the belief that the easing of the lockdown regulations will allow more sectors of the economy to resume business activity.

• Confidence regarding general agricultural conditions improved by 27 points to 79 in the third quarter, which is the highest level since the second quarter of 2014, indicating a good agricultural season. This optimism was expressed by most respondents of the survey and largely based on improved weather conditions in the Western Cape, and prospects of good rains in 2020/21 season across the country. There are already reports of a possible La Niña, which should bring above-average rainfall in most regions of South Africa in the 2020/21 summer season.

• Meanwhile, the sentiment regarding the employment subindex fell by 2 points from the second quarter to 33, which is the lowest level since the third quarter of 2005. This is an indication that agricultural employment probably took a knock primarily because of various health protocols, such as social distancing, that had to be adhered to, as an attempt to limit the spread of the coronavirus. A decline in employment has probably been within the seasonal labour.

• The debtor provision for bad debt and financing costs subindices are interpreted differently from the above-mentioned indices. A decline is viewed as a favourable development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the third quarter of 2020, the sentiment regarding both subindices, debtor provision for bad debt and the financing costs, increased by 2 and 7 points from the second quarter to 28 and 82, respectively, and went into an unfavourable direction.

As in the previous quarter, these results were surprising given that the South African Reserve Bank has cumulatively cut interest rates by 300 basis points thus far this year. This suggests that lenders may have become more risk-averse due to Covid-19-related uncertainty.

The third-quarter results of the ACI are generally in line with the positive high-frequency data of the past few months in South Africa’s agriculture. This is because most of the sector was classified as essential and did not close down during the strict lockdown period. Mostly, this is a recovery year in agricultural output across all subsectors (field crops, horticulture and livestock) following prolonged periods of drought.

The weaker exchange rate and minimal disruptions in logistics have also allowed the sector to register robust export activity in the first three quarters of this year, particularly as port activity normalised. With that said, not all is rosy in agriculture. The wine and tobacco industries are amongst those that are still feeling the negative effects of the prohibition of sales for several weeks during the strick lockdown.