The Resilient stable includes the likes of Resilient REIT, NEPI Rockcastle, Fortress Income Fund and Greenbay Properties. The recent sell-off has been the result of rumours of a Viceroy research report, which we now know was actually targeted at Capitec. Another reason has been hedge funds short-selling the Resilient stable. On 9 February 2018, after market close, Resilient put out a note identifying the party behind the large short position and the negative note as a well-known South African hedge fund manager.

One of the key criticisms of the Resilient stable is that the group of companies continuously raise equity capital and subscribe to each other’s shares, which means too much value stems from financial engineering instead of the underlying bricks-and-mortar assets. This results in an inflated share price in comparison to other property counters. On the other hand, property managers in South Africa have stated that all the members of the Resilient stable have invested in dominant regional malls in SA and abroad, implying that the counters are underpinned by quality assets. Fortress owns high-end warehousing and light industrial property in SA; Nepi Rockcastle owns malls in eight East European countries; Resilient REIT invests in regional malls in SA; and Greenbay Properties invests in global infrastructure funds as well as distressed European property. Following the Steinhoff debacle, corporate governance, source of earnings and companies’ ownership structures have come under scrutiny.

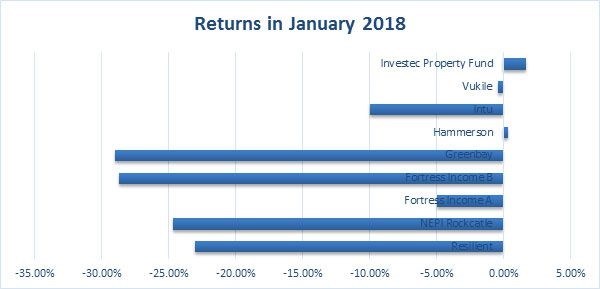

The Resilient stable accounts for 40% of the property sector by free-float market capitalisation, which is why the recent poor performance has been topical. For the month of January 2018, the SA Listed Property Index posted a total return of -9.91%, dragged lower by the Resilient stable.

As seen in Figure 1, the Resilient stable had a torrid month. Resilient REIT (-23.00%), NEPI Rockcastle (-24.66%), Fortress Income Fund A (-4.96%), Fortress Income Fund B (-28.72%) and Greenbay Properties (-29.02%) were all significantly weaker over the month of January. Year-to-date, as at the end of 8 February 2018, the return figures of the counters are as follows: Resilient REIT (-26.94%); NEPI Rockcastle (-33.21%); Fortress Income Fund A (-6.52%); Fortress Income Fund B (-34.60%); and Greenbay Properties (-26.67%).

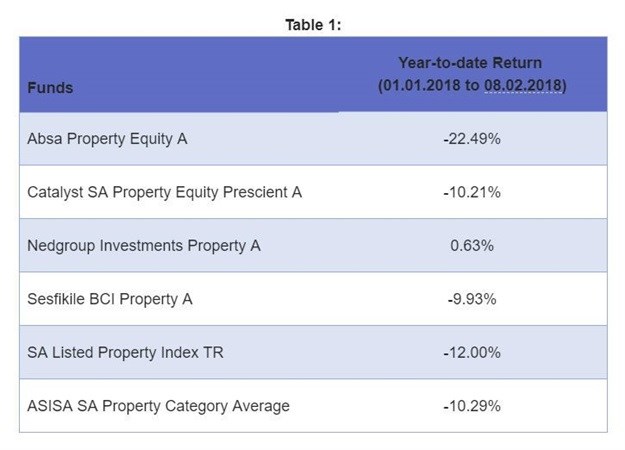

Before addressing Table 1, it is important to understand that the majority of the South African property unit trust funds are benchmark-cognisant, implying that their portfolio construction begins by looking at the counters in the benchmark and then overweighting or underweighting the counters given where the respective portfolio managers see value. For comparison purposes, I’ve included two benchmark-cognisant funds, namely the Catalyst SA Property Equity Prescient Fund and the Sesfikile BCI Property Fund, and two benchmark-agnostic funds, namely the Absa Property Equity Fund and the Nedgroup Investments Property Fund (managed by Bridge Fund Managers). Benchmark-agnostic implies that the portfolio manager does not make use of the benchmark when constructing their portfolio. The Nedgroup Investments Property Fund is a concentrated, dividend-focused fund, with the top 10 holdings accounting for 79.8% of the portfolio. This fund has no exposure to the Resilient stable. The Absa Property Equity Fund will reflect the portfolio manager’s high-conviction views. As a result, this portfolio will be concentrated among a few counters, and in this case, it had a large exposure to the Resilient stable.

As seen in Table 1, the Absa Property Equity Fund was the worst hit, surrendering 22.49%, followed by the Catalyst SA Property Equity Prescient Fund, down 10.21%, then the Sesfikile BCI Property Fund, which gave up 9.93%. Over the same period, the Nedgroup Investment Property Fund bucked the overall trend and closed 0.63% higher. The SA Listed Property Index weakened 12% and the ASISA SA Category Average return was -10.29%, implying that Resilient stable’s pain has been felt across the entire category.