Following a strong four months to period end, growth in distributable earnings increased as a result of a higher than budgeted hotel-related income, a yield accretive acquisition being concluded, and lower than budgeted finance costs due to budgeted interest rate increases not being implemented by the South African Reserve Bank.

Commenting on the overall result, CEO Mike Flax said: “The continued strong performance of the Western Cape property sector and the regional specialisation of Spear insulates the company to a degree from the current weak economic climate. Our Western Cape focus coupled with management’s proximity to assets will continue to stand the company in good stead well into the future, given the continued and successful implementation of our strategy to only invest in high quality assets in the province along with our healthy pipeline of greenfield and brownfield redevelopment opportunities."

The board declared a first dividend of 23.51c per share on 11 May 2017. This is an increase of 16.75% over the forecasted dividend of 20.14c per share as per the PLS dated 21 October 2016. Regarding net asset value, the tangible net asset value per share increased by 7.01% from the forecasted R9.37 per the PLS to R10.03 per share. The increase is driven by an increase in fair value of investment property of 3.79% and lower debt levels of 8.36%.

Quintin Rossi, MD of Spear REIT Limited adds, "The board is confident that demand for quality rental properties across the various sectors within the Western Cape will continue as the effects of semigration create additional demand for rental properties. Along with the strong property fundamentals, the company should achieve a full year distribution for the forthcoming year of 76c - 78c. This is ahead of the forecasted distribution in the pre-listing statement. This viewpoint is premised on a number of factors including a relatively stable macro-economic environment prevailing, lease renewals being concluded as per the company forecast and no major tenant failures taking place. Tenants must also successfully absorb rising costs associated with utility consumption charges and municipal rates.”

The group took transfer of the following properties after year-end:

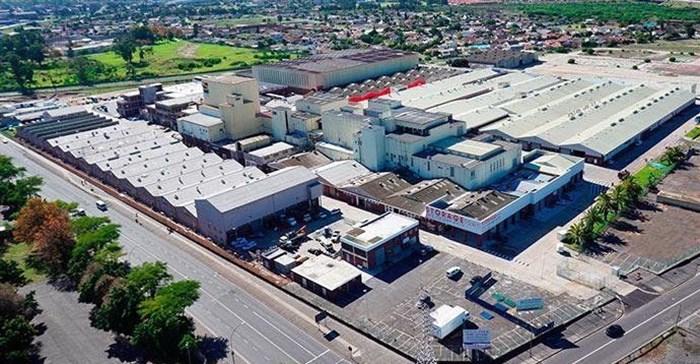

The group entered into agreement to acquire the following properties, amounting to a total value of over R1bn:

The expected transfer date for these properties is 1 July 2017, with the exception of Mega Park which is expected on 1 June.