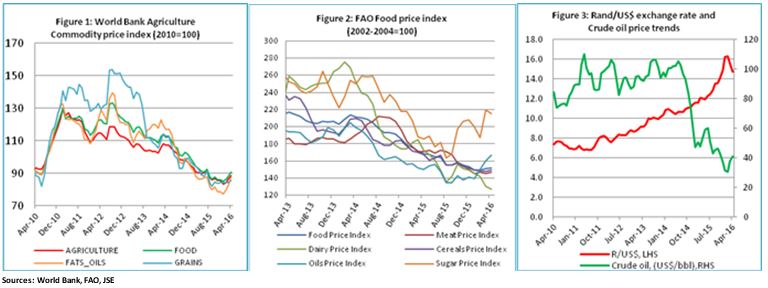

International prices of most agricultural commodities trended lower for most of 2015 before rebounding slightly in the last two months. The only exception was sugar, which increased on concerns over prospects of a global deficit. He says that during times of domestic supply deficits, imports are supposed to fill the gap. However, this has not been the case for South Africa as agricultural imports became expensive due to the weakening Rand.

“Moreover, crude oil prices reached record lows and this resulted in a decline in international freight costs, making it cheaper to transport agricultural commodities globally. Nonetheless, South Africa still could not benefit from this decline,” adds Makube.

The United Nations Food and Agriculture Organisation (FAO) recently projected global output of coarse grains for 2017 to 1.313m tons, almost 11m higher y/y. Meanwhile, the United States Department of Agriculture (USDA) recently pegged the US 2016/17 production up 6% y/y at 366m tons in its May 2016 World Agricultural Supply and Demand Estimates (WASDE) report. The world production estimate came in at 969m tons for 2015/16 and 1.01 billion for 2016/17.

Makube says “The implication of this bullish production outlook for 2016 is that international prices will retain the downside bias”.

Domestically, the supply outlook from grains remains tight until mid-2017 when the 2016/17 harvest enters the market. Grain production is expected to rebound strongly in the season ahead due to the increase in planted area and better production conditions.

Recent weather forecasts indicate that the El Niño pattern is weakening and a transition to ENSO-neutral is likely during late Northern Hemisphere spring or early summer 2016, with an increasing chance of La Niña during the second half of the year. “As a result, we are likely heading for a good season as the La Niña weather pattern normally leads to above-normal rainfall in the Southern African region,” adds Makube.

The short to medium term outlook for food inflation remains biased to the upside due to supply constraints and a weaker Rand which make imports more expensive. Risks to the Rand outlook include the aggressive Fed rate hikes, a downgrade by credit rating agencies and the deterioration in the domestic socio-economic situation.

“In the longer term, agricultural production is expected to bounce back in 2017 and it is then that we could realise a significant moderation in food prices, particularly grains. Fruit and vegetable prices could still ease towards the end of the year should the improved weather outlook materialise in the next rainfall season,” concludes Makube.

International agricultural commodity prices have been trending lower as reflected in the commodity indices below.